By Derric Matz, Apex Mortgage Group Inc.

Home equity isn’t just the portion of your home you truly “own”—it’s one of the most valuable financial tools you can have. As of early 2025, the average U.S. homeowner with a mortgage has over $300,000 in equity, demonstrating just how substantial this asset can be.

Equity provides both long-term wealth and financial flexibility, offering advantages that go far beyond simply owning a home.

Forced Savings: Every mortgage payment you make gradually increases your ownership stake in your home.

Appreciation Potential: Unlike cars or other depreciating assets, homes often appreciate over time due to market conditions, location, and improvements—further boosting equity.

Increased Net Worth: A growing equity stake directly improves your financial stability and overall net worth.

Home equity can be borrowed against at relatively low interest rates, because the loan is secured by your home. Options include:

Home Equity Loans: A lump sum with a fixed interest rate and repayment schedule.

Home Equity Lines of Credit (HELOCs): A revolving line of credit you can access as needed during a draw period.

Equity also acts as a safety net, providing funds for major expenses or life events:

Emergency Funding: Cover unexpected costs like home repairs or medical bills without draining savings.

Debt Consolidation: Combine higher-interest debts into one lower-interest payment.

Funding Major Goals: Renovations, a child’s education, or a down payment on a second home.

Future Planning: When you sell your home, a larger equity stake means more cash for your next home, investments, or retirement.

Equity moves with home prices: when prices rise, equity grows; when prices cool, growth slows. After the record surges of 2020 and 2021, some market moderation was expected. While more homes are now on the market, slowing price growth doesn’t mean you’ve lost ground.

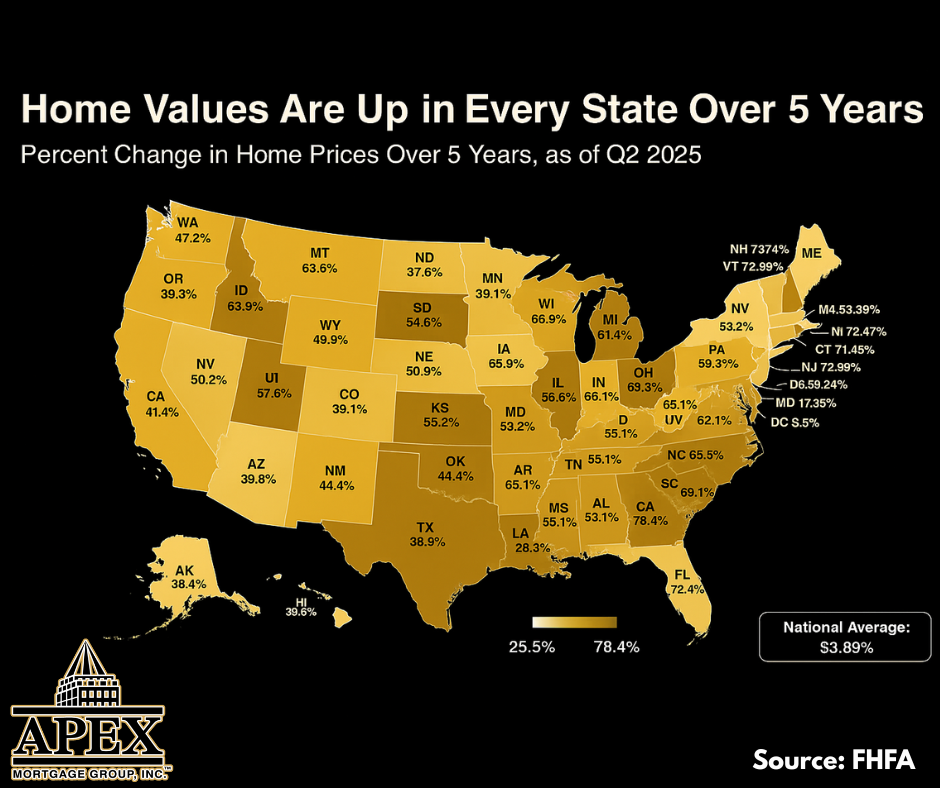

In fact, according to Zillow, home prices nationwide have risen 45% since March 2020. Even in markets with declines, the average drop is only around 4%, far outweighed by gains over the last five years. FHFA data confirms that every state has seen home price increases over this period, meaning homeowners everywhere have built significant equity.

Modest declines can’t erase years of growth—homeowners who’ve stayed in their homes for several years are still far ahead.

Worried about a larger market downturn? Jake Krimmel, Senior Economist at Realtor.com, notes:

“The slight recent declines in aggregate value and total home equity are not cause for concern… large price declines nationally are extremely unlikely in the near term.”

This market moderation is a healthy sign, signaling balance after years of rapid price growth. Most homeowners remain in an incredibly strong position.

Even with minor price drops in some areas, today’s homeowners are sitting on near-record amounts of equity. That equity isn’t just numbers on paper—it’s a powerful tool for building wealth, funding goals, and securing financial stability.

Curious how much equity you’ve built? Connect with a Apex Loan Officer—you might be surprised at what your home is worth today.

Sources: Keeping Current Matters, Zllow, FHFA

National Director of Marketing

Apex Mortgage Group, Inc | NMLS: 1069868