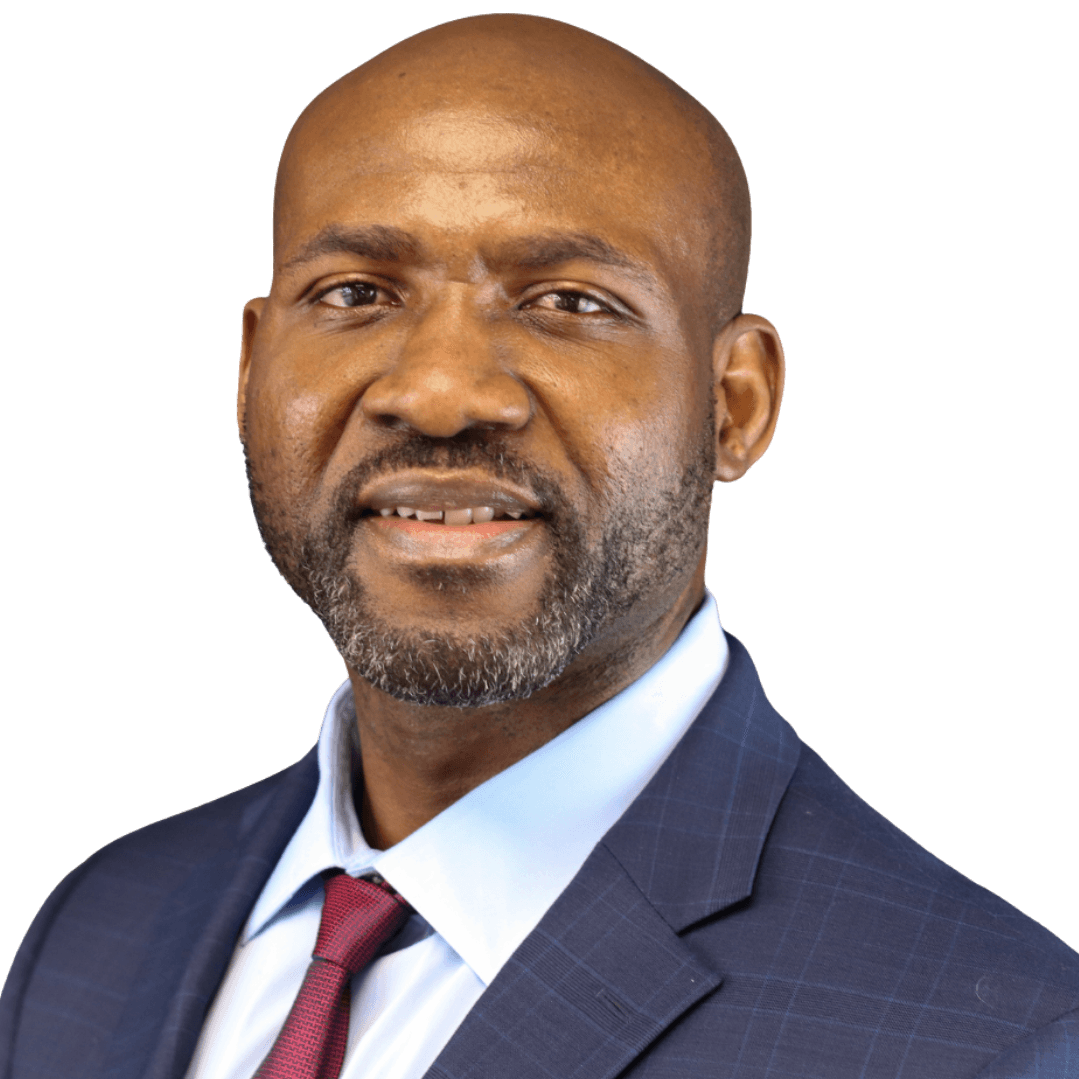

Whether you're buying, selling, refinancing, or building your dream home, you have a lot riding on your loan specialist-and on your real estate professional. I'm proud to bring both perspectives to the table as a licensed mortgage professional and a licensed real estate broker with a trusted real estate investment firm offering leasing, sales, and business brokerage services.

My team and I provide tailored solutions to meet your real estate and business goals â whether that means finding the right property, structuring a smart financing plan, or navigating the sale of an investment.

Because market conditions and mortgage programs change so often, it's important to have someone in your corner who can provide accurate, up-to-date advice and help you make confident decisions. With my background in both real estate and lending, I can guide you through the entire process â from financing to closing â with a clear strategy that aligns with your goals.

My priority is to make sure you make the best choice for you and your family, and to deliver a level of personalized service that exceeds expectations. I invite you to explore my website, learn more about the loan programs and tools available, and apply online in just four easy steps.

Once your application is submitted, I'll reach out to review your loan details and next steps-or you can conveniently schedule a one on one meeting with me online. As always, you're welcome to contact me anytime by phone, email, or in person for expert advice and customized solutions.

Calculate your mortgage payment, affordability & more

Find out which loan program is right for you

Get pre-approved in minutes with our quick & easy app

Get insight on trending news and mortgage happenings with our weekly blog

Committed to giving you all the support and guidance you need.

A conventional loan is a type of loan that doesn't have government backing or insurance, unlike FHA, VA, and USDA loans, which are insured by the government. Conventional mortgage loans, whether conforming or non-conforming, usually require a slightly larger down payment than some government loans. However, conventional loans offer more flexibility and fewer restrictions for borrowers, especially those borrowers with good credit and steady income.

Your credit payment history is recorded in a file or report. These files or reports are maintained and sold by "consumer reporting agencies" (CRAs). One type of CRA is commonly known as a credit bureau. You have a credit record on file at a credit bureau if you have ever applied for a credit or charge account, a personal loan, insurance, or a job. Your credit record contains information about your income, debts, and credit payment history. It also indicates whether you have been sued, arrested, or have filed for bankruptcy.

On a conventional mortgage, when your down payment is less than 20% of the purchase price of the home mortgage lenders usually require you get Private Mortgage Insurance (PMI) to protect them in case you default on your mortgage. Sometimes you may need to pay up to 1-year's worth of PMI premiums at closing which can cost several hundred dollars. The best way to avoid this extra expense is to make a 20% down payment, or ask about other loan program options.

It's generally a good time to refinance when mortgage rates are 2% lower than the current rate on your loan. It may be a viable option even if the interest rate difference is only 1% or less. Any reduction can trim your monthly mortgage payments. Example: Your payment, excluding taxes and insurance, would be about $770 on a $100,000 loan at 8.5%; if the rate were lowered to 7.5%, your payment would then be $700, now you're saving $70 per month. Your savings depends on your income, budget, loan amount, and interest rate changes. Your trusted lender can help you calculate your options.

An Appraisal is an estimate of a property's fair market value. It's a document generally required (depending on the loan program) by a lender before loan approval to ensure that the mortgage loan amount is not more than the value of the property. The Appraisal is performed by an "Appraiser" typically a state-licensed professional who is trained to render expert opinions concerning property values, its location, amenities, and physical conditions.

Senior Loan Officer

Apex Mortgage Group, Inc | NMLS: 2555772